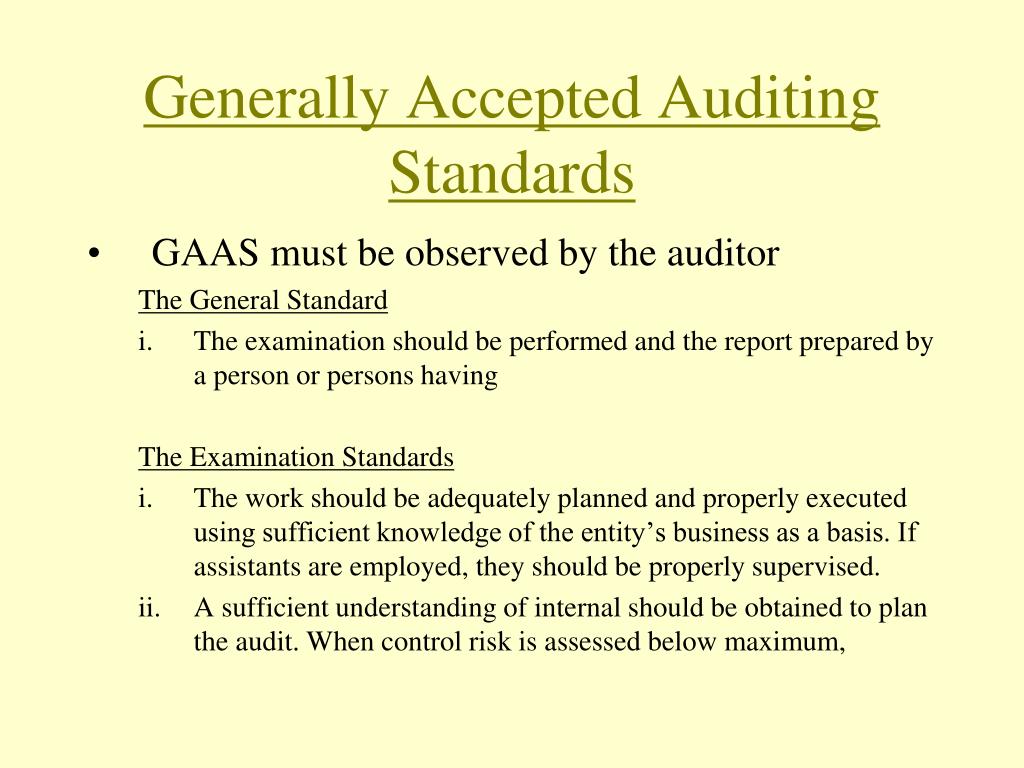

Auditing Standards The audit is to be performed by a person or persons having adequate technical training and proficiency as an auditor. In all matters relating to the assignment, an independence in mental attitude is to be maintained by the auditor or auditors. Due professional care is to be. Commonly referred to as generally accepted government auditing standards (GAGAS), provide the foundation for government auditors to lead by example in the areas of independence, transparency, accountability, and quality through the audit process.

Overview.About The Yellow BookThe Yellow Book is used by auditors of government entities, entities that receive government awards, and other audit organizations performing Yellow Book audits. It outlines the requirements for audit reports, professional qualifications for auditors, and audit organization quality control. Auditors of federal, state, and local government programs use these standards to perform their audits and produce their reports.The 2018 revision of the Yellow Book is effective for financial audits, attestation engagements, and reviews of financial statements for periods ending on or after June 30, 2020, and for performance audits beginning on or after July 1, 2019. Early implementation is not permitted.So, what's new in the 2018 revision? What advice do we have for Yellow Book users? Listen to our podcast about the 2018 Yellow Book to find out. 5:19GAGAS Amendments & Interpretive GuidanceAt this time, there are no amendments or interpretive guidance for the 2018 revision of Government Auditing Standards.Yellow Book revisions undergo an extensive, deliberative process, including public comments and input from the Comptroller General's Advisory Council on Government Auditing Standards.

GAO considers all Yellow Book comments and input from the Comptroller General's Advisory Council on Government Auditing Standards when finalizing revisions to the standards. Read more in our 2018 Yellow Book.Printed CopiesPurchase printed copies of the and online through the Government Publishing Office or by calling 202-512-1800 or 1-866-512-1800.GAO ContactFor technical assistance regarding the Yellow Book, please call (202) 512-9535 or e-mail. GAO Comment LettersGAO provides comments to other standard-setting organizations’ proposals in letter form.

The comment letters discuss technical issues related to ethics, quality control, accounting, auditing, and attestation standards. By issuing comment letters, GAO promotes the development of high quality government and private sector auditing standards, both domestically and internationally. Listed below are comment letters relating to auditing standards and other topics of interest to the accounting and auditing community.Comment Letters Sent (provided in chronological order).

Advisory CouncilThe Comptroller General of the United States appointed the Advisory Council on Government Auditing Standards to review the standards and recommend necessary changes. The Council includes experts drawn from:. federal, state, and local government;. the private sector; and. Star fox zero controls. academia.The views of all parties were thoroughly considered in finalizing the standards.

Advisory Council members serve 4-year terms and may be reappointed by the Comptroller General. Advisory Council Members, 2016-2020 NameOrganizationDrummond Kahn,ChairFaculty, International Institute and Government Audit Training InstituteGraduate School USACorey ArvizuPartnerHeinfeld, Meech & Co., P.C.Dr.

BakerAssistant Inspector General for AuditU.S. Nuclear Regulatory Commission, Office of the Inspector GeneralJon HatfieldInspector GeneralU.S. Federal Maritime Commission, Office of the Inspector GeneralPhilip M. HeneghanInspector GeneralU.S. International Trade Commission, Office of the Inspector GeneralMary L. KendallDeputy Inspector GeneralU.S.

Department of the Interior, Office of Inspector GeneralDeborah V. LovelessDirectorTennessee Comptroller of the Treasury, Division of State AuditMartha S. MavredesAuditor of Public AccountsCommonwealth of VirginiaKim McCormickPartnerGrant Thornton LLPAmanda NelsonPartnerKPMG LLPDr. Demetra Smith NightingaleInstitute FellowUrban InstituteDr. PridgenAssociate ProfessorJackson State UniversityDianne RayColorado State AuditorColorado Office of the State AuditorHarriet RichardsonInspector GeneralSan Francisco Bay Area Rapid Transit DistrictRandy C.

RobertsSenior Technical DirectorArizona Office of the Auditor GeneralBrian A. ScheblerNational Director of Public Sector ServicesRSM US LLPRonald SmithPrincipalRHR Smith & Company CPAs. Related Publications.Standards and GuidanceAuditors may use the Yellow Book in conjunction with professional standards issued by GAO and other authoritative bodies. GAO also issues guidance on implementing and complying with standards.Professional Standards Updates (PSUs) summarize recently-issued standards of major auditing and accounting standard setting bodies. These updates inform the Yellow Book user community of important changes to professional requirements. These updates do not establish new professional standards and do not reflect GAO official views on these requirements.